LIC’s got your back (and wallet)! Their new credit card boasts FREE Rs 5 lakh insurance and exciting rewards on premium payments. Learn about eligibility, benefits, and how to apply in this comprehensive guide.

LIC Credit Card: The credit card from Life Insurance Corporation of India (LIC) has been released. LIC Classic and LIC Select are two new credit card varieties that the company has introduced in association with MasterCard and IDFC First Bank.

More than 27 crore policyholders nationwide will have the chance to save money with this credit card by earning reward points for each LIC insurance premium paid. Numerous offers are being made to customers on LIC’s two new credit cards. With the recently announced LIC Credit Card, you may get benefits like low interest rates, no sign-up fees, bonus points, and random protection up to Rs 5 lakh.

On December 14, 2023, LIC Classic and LIC Select, two co-branded credit cards from IDFC FIRST Bank, LIC Cards, and Mastercard, were introduced. Both cards come with a plethora of features and perks, including 0% interest rates, reward points, zero joining fees, low interest rates, and personal accident coverage of up to Rs 5 lakh. Although having a LIC policy is not required in order to apply for these credit cards, having a coverage will reward you for paying your insurance premiums.

There will be additional perks as well, such liability coverage for misplaced cards up to ₹50,000 and personal accident insurance up to ₹5 lakh.

Packed with additional perks including no annual or joining fees and affordable interest rates as low as 9%, the new card is intended to assist customers of all ages across the nation, according to the companies.

Additionally, reward points can be used by cardholders against any online transaction, including future LIC insurance premiums.

There will be travel privileges on both card variations, including free access to airport and train station lounges, as well as additional coverage like personal injury insurance. In addition, cardholders receive ₹1,399 worth of roadside assistance and a waiver of 1% fuel surcharge.

Not requiring any LIC policy:

Let us tell you that you can still apply for a LIC credit card even if you do not currently have a policy with LIC. These credit cards do not require LIC policy. On the other hand, using your LIC credit card to pay the premium will earn you additional points if you have an insurance policy.

LIC Classic Credit Card Advantages:

As per the website of IDFC First Bank, the LIC Classic Credit Card offers several advantages.

- Zero joining fee and zero annual fee.

- Interest rates start from 0.75% per month or 9% per annum. It can reach 3.5% per month or 42% per year.

- Interest free cash withdrawal service will be available for 48 days at domestic and international ATMs.

- For EMI you will have to pay a fee of Rs 199 per transaction.

- Late payment charges will be 15 percent of the total payment amount. It is minimum Rs 100 and maximum Rs 1250.

- The foreign exchange markup charge for all international transactions will be 3.5 per cent.

Advantages of Registering for a LIC Credit Card:

- You will get 1000 bonus points on spending the first Rs 5000 within 30 days of card creation. Cashback of 5% (up to Rs 1,000) will be available on the first EMI transaction within 30 days of card creation.

- Rs.500 off on Yatra domestic flight bookings.

- Flat Rs.500 Off on Purchases of Rs.899 & Above at MYGLAMM.

- 6 Months Free FarmEasy Plus Subscription worth Rs.399.

- 1 year free Lenskart Gold membership worth Rs 500.

Additional LIC Select Credit Card advantages:

- Two complimentary passes every quarter to domestic airport lounges

- Four complimentary passes to train lounges each quarter

- A 1% fuel fee waiver is available at all petrol stations in India, up to a monthly maximum of Rs 300. Only transactions with values between Rs. 200 and Rs. 500 would be eligible for it.

Benefits of Insurance on LIC Credit Card:

You can get Personal Accident Insurance up to Rs 2,00,000 with just one LIC Classic Credit Card purchase.

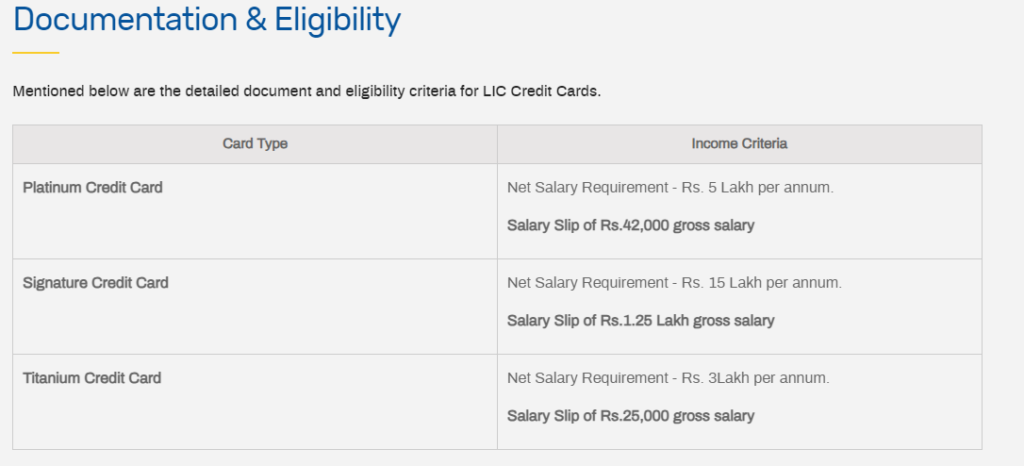

Documentation & Eligibility:

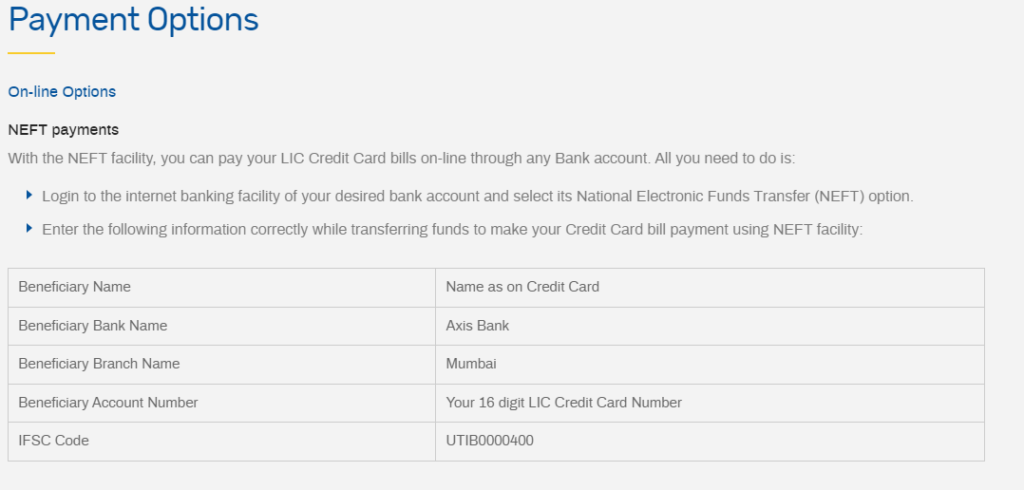

Payment Options:

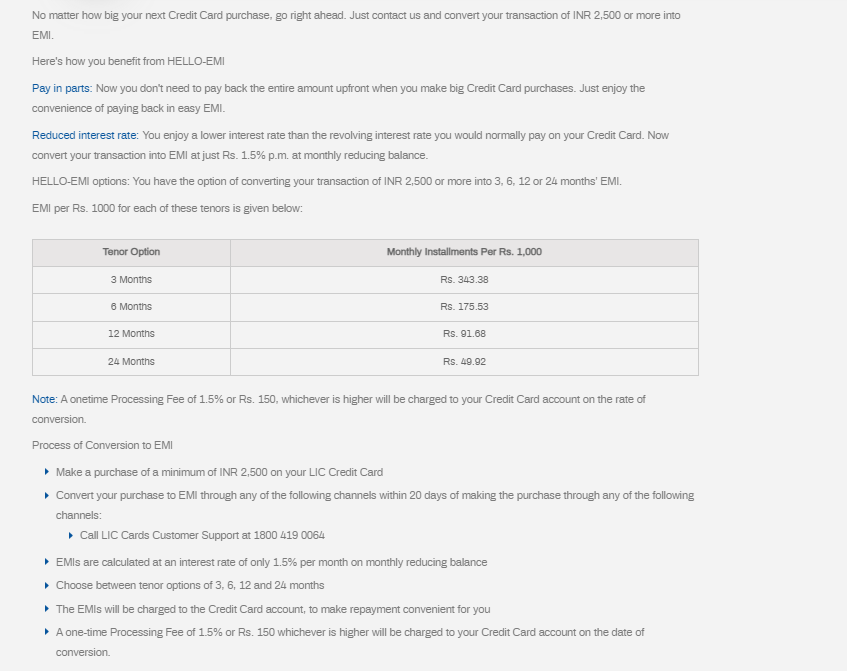

Emi Facility:

(Note: All info collect from – Lic cards)

You May Also Read: