Filing an Income Tax Return (ITR) is a critical requirement under the Income-tax Act, 1961, enabling taxpayers to report their income, deductions, investments, and taxes. Even if your income doesn’t meet the taxable threshold, filing an ITR is necessary for carrying forward losses, claiming refunds, and meeting various financial requirements like visa applications, bank loans, or insurance.

E-filing, or online filing of ITR, offers convenience and accuracy. By accessing the new income tax portal with PAN-based login credentials, taxpayers can utilize several features designed to simplify the filing process.

Documents Required for E-filing ITR:

- PAN and Aadhaar

- Bank statements

- Form 16

- Donation receipts

- Stock trading statements

- Insurance premium receipts (life and health)

- Bank account details linked to PAN

- Aadhaar-registered mobile number for e-verification

- Interest certificates from banks

At worldwidenews.in, you can e-file your ITR effortlessly by simply contacting our financial team with your PAN. Most details like salary income, TDS, and deductions, are auto-filled out by the Income Tax Department.

Latest Update:

The Income Tax e-filing portal now includes a ‘Pay Later’ option, allowing taxpayers to complete their filing before making tax payments.

Step-by-Step Guide to E-file ITR on the Income Tax Portal:

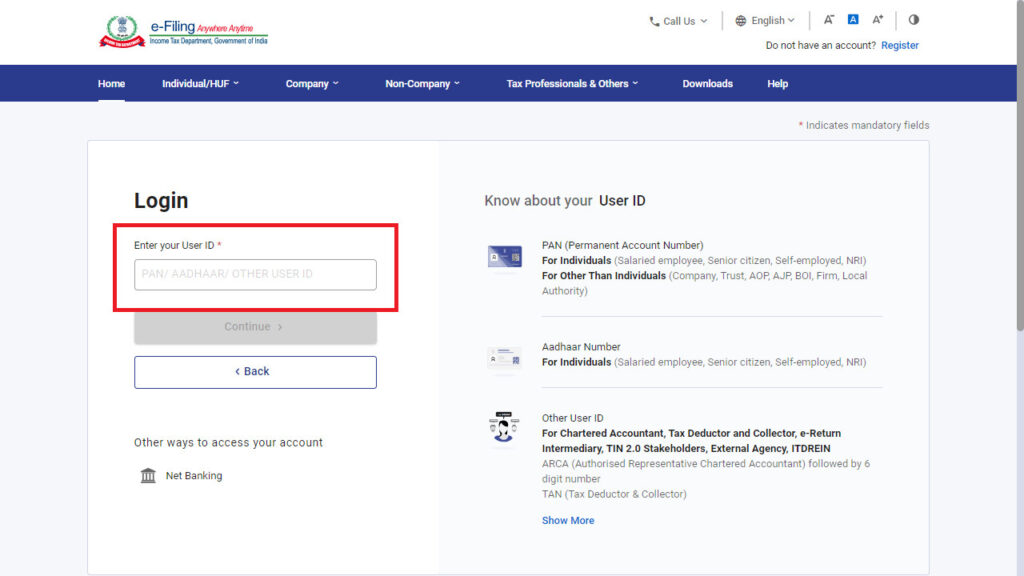

Step 1: Login

- Visit the official Income Tax e-filing website and click on ‘Login‘.

- Enter your PAN in the User ID section and click ‘Continue’.

- Check the security message and proceed by entering your password.

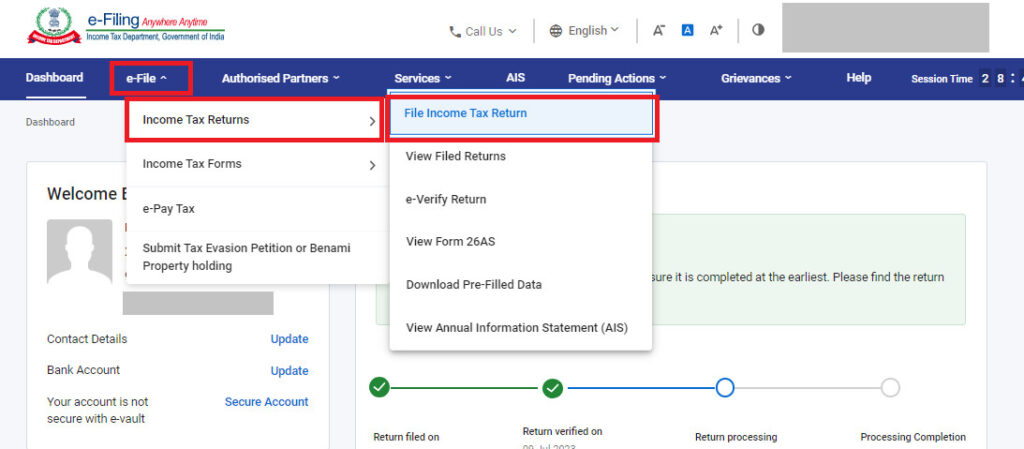

Step 2: File Income Tax Return

- Click on the ‘e-File’ tab > ‘Income Tax Returns’ > ‘File Income Tax Return’.

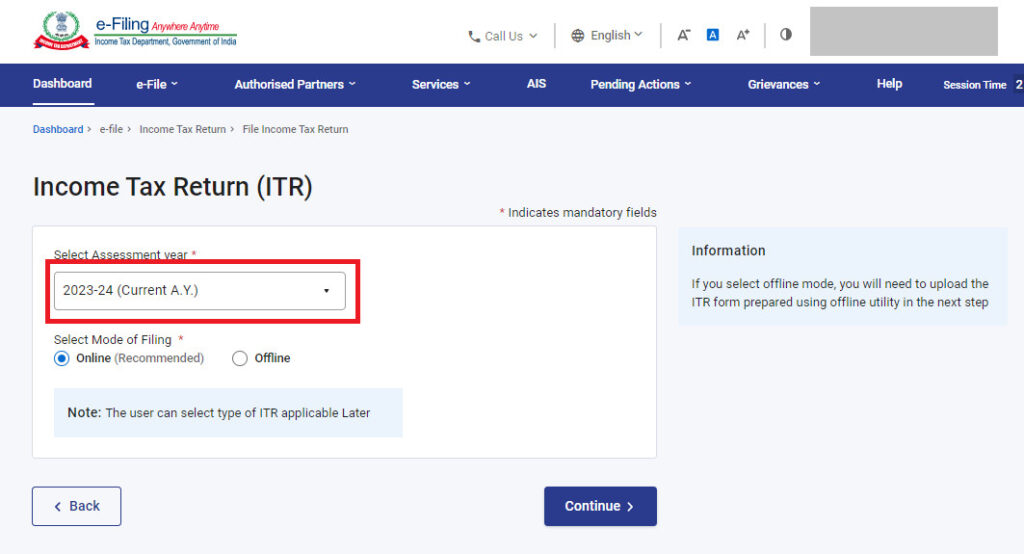

Step 3: Select Assessment Year

- Choose ‘AY 2024-25’ for filing FY 2023-24 returns. Ensure the mode of filing is set to ‘Online’. Select whether it’s an original or revised return.

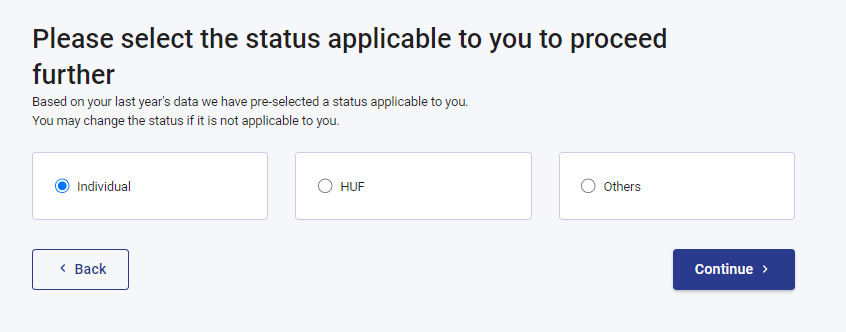

Step 4: Select Filing Status

- Select your filing status: Individual, HUF, or Others. For most individuals, choose ‘Individual’ and continue.

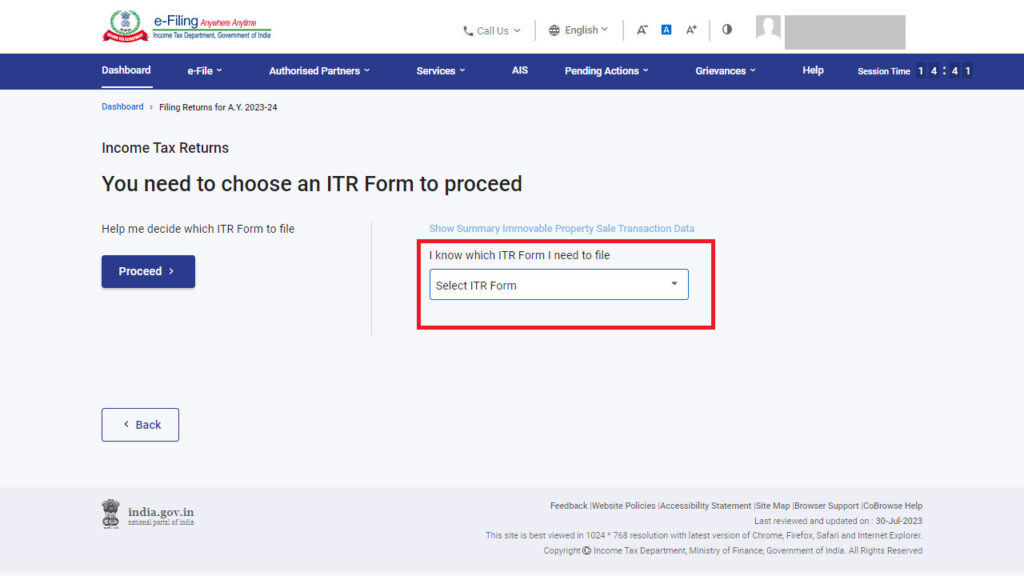

Step 5: Choose ITR Type

- Select the appropriate ITR form based on your income sources and deductions. Forms range from ITR 1 to ITR 7, with ITR 1 to ITR 4 applicable for Individuals and HUFs.

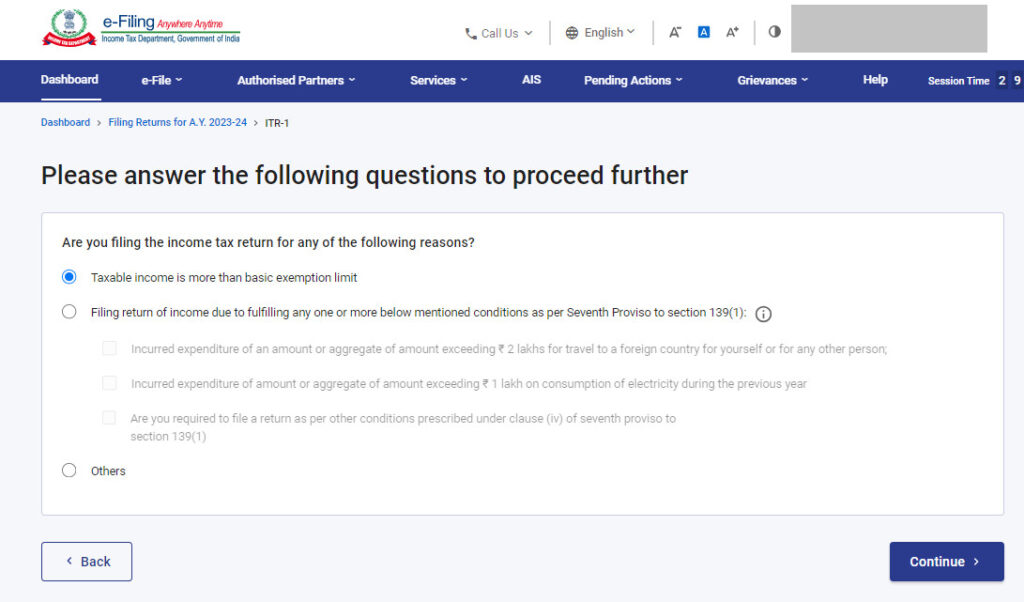

Step 6: Specify Reason for Filing ITR

- Indicate why you are filing your returns: taxable income above basic exemption, mandatory requirement, or other reasons applicable to your situation.

- Don’t forget to claim deductions. Mentioning most important one.

Under Section 80C of the Income Tax Act, 1961, you can claim deductions for various investments and expenses. Some of the common claims that can be made under Section 80C include:

Life Insurance Premium: Premiums paid towards life insurance policies for yourself, spouse or children are eligible for deduction.

Employee Provident Fund (EPF): Contributions made to EPF by salaried individuals are eligible for deduction.

Public Provident Fund (PPF): Investments made in PPF accounts are eligible for deduction.

Equity Linked Saving Scheme (ELSS): Investments in ELSS mutual funds qualify for deduction under Section 80C.

National Savings Certificates (NSCs): Investments in NSCs issued by the post office qualify for deduction.

Home Loan Principal Repayment: The principal component of your home loan EMI is eligible for deduction under Section 80C.

Tuition Fees: Payments made towards tuition fees of children’s education in any school, college or university located in India are eligible for deduction.

Please note that there is an overall limit on the maximum amount that can be claimed as a deduction under Section 80C, which is currently set at Rs. 1.5 lakh per financial year.

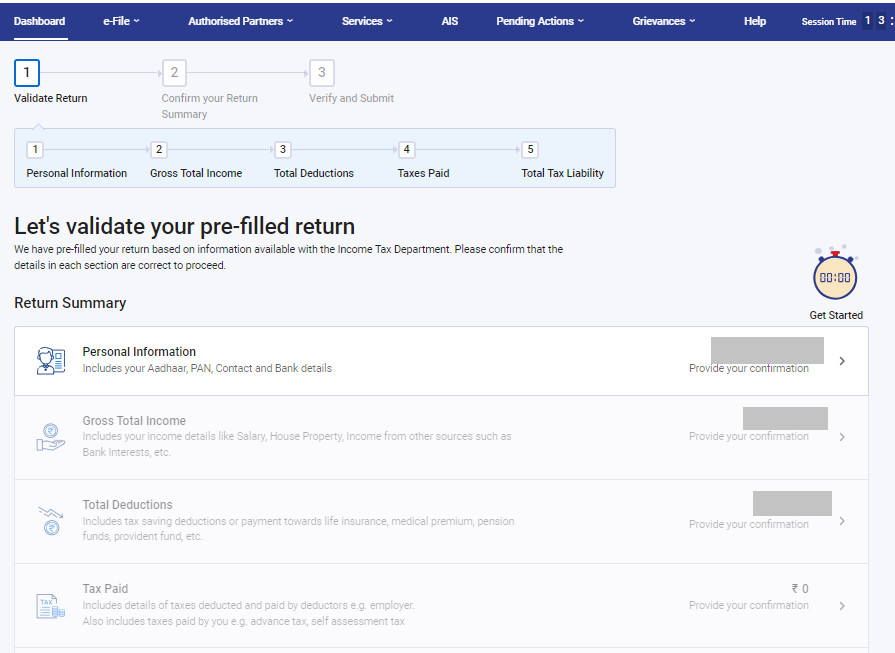

Step 7: Validate Pre-filled Information

- Review pre-filled details such as PAN, Aadhaar, personal information, and bank details. Ensure accuracy and completeness. If not pre-validated, provide necessary bank account information.

Step 8: Verify and Submit ITR

- Disclose all relevant income, exemptions, and deductions. Confirm the summary of your returns, validate details, and pay any outstanding taxes.

- E-verify your return within 30 days using options like Aadhaar OTP, EVC, Net Banking, or by sending ITR-V to CPC, Bengaluru.

Filing your ITR online ensures compliance with tax regulations and facilitates seamless management of your financial affairs. Stay informed about updates and changes in tax laws to streamline your filing experience.

For detailed instructions and to begin e-filing your ITR on worldwidenews.in, visit the Income Tax Department’s e-filing portal here.

This version maintains a professional tone while incorporating a clear, step-by-step approach to filing taxes, ensuring it is informative and user-friendly for taxpayers.